Michael Burry, of “Big Short” fame, recently shut down his hedge fund and started a Substack with an educational goal. I enjoy following his musings because he’s not afraid to say what he thinks, even if I often don’t agree (or have any idea what he’s obliquely referring to). He recently posted a “foundational” article that is supposed to show his thinking process, with a familiar beginning:

For those that do not trust anything analog, since 1990, there have been over 750 replacements in the S&P 500 Index. Google’s Gemini 3 Pro swears by it. Claude Max agrees.

Gemini 3 Pro and Claude Max further propose that 45% of the top 20 names in the 1999 NASDAQ 100 ended up bankrupt or acquired after a >75% loss. This checks out, my conference room says.

Capital is always fighting to be recycled.

Thusly, you now carry the knowledge that most investors are best off in an index – and have no need to invest in individual stocks.

If one is rather young and has 50-70 years left, then one absolutely should be almost entirely invested in common stock indices, preferably the S&P 500 or the Nasdaq 100 or both. Live life, touch grass, achieve real things, automatically reinvest dividends, and let the compounding of the Index Gods do the work. Maybe not this very day, but over time, this is the way for most.

Of course, some of us just do…not…want…easy.

For them, well, their God gave them GameStop.

He then goes very deep into how he analyzed GameStop and through skill and smarts, of course made some nice returns on the trade.

This is the central humblebrag of professional investors. *You* should index, but here’s what *I* do instead. If you are a motivated person who studies investing with an honest and open mind, you realize that you probably shouldn’t really be actively trading. But if you are a motivated person who studies investing, you probably think you are in the tiny minority that can make money reliably with actively trading. Smart enough to turn off “easy” mode.

This is the central struggle for all individual investors. The problem with “easy” is that it is also boring and often slow. Meanwhile, your Robinhood app or equivalent will happily sell you:

- Crypto, including memecoins that have zero utility.

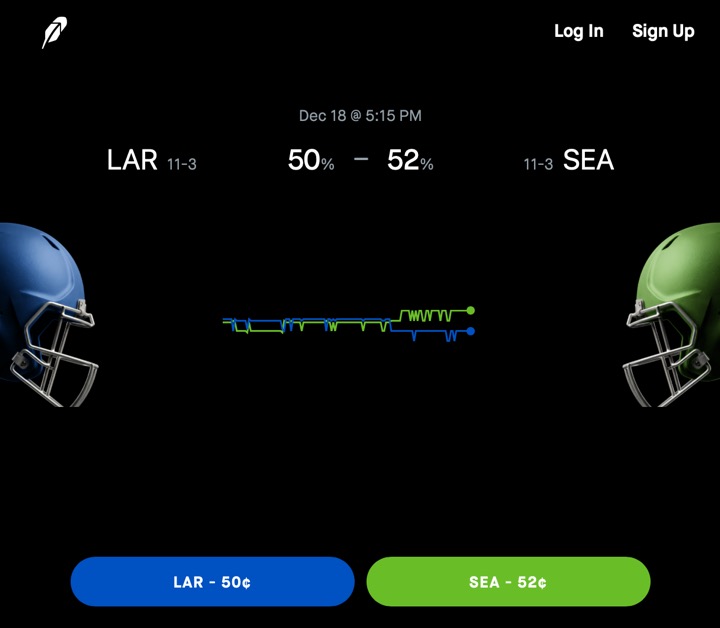

- Gambling, err “Prediction markets” on this weekend’s NFL game.

- “Dividend” ETFs with a crazy 12% yield that some think will last forever.

- Aggressive options that can lose all your money within days.

- “Boomer candy” ETFs that promise stock-like upside with zero downside.

- Index “Plus”. Index with extra ketchup. Index minus the ketchup. Just 25 basis points extra!

I spend a lot of my own time doing just this – reading across various corners in the investing world but repeatedly convincing myself to pick “easy”. I’ll read this article and enjoy it (update: it appears to have gone from free to behind a paywall since this writing), but I don’t need to analyze GameStop.